“C-Beauty” or “K-Beauty”? Who will win the booming Indian beauty market?

On July 21st, K Venkataramani, CEO of India’s largest beauty retailer Health & Glow (hereinafter referred to as H&G), attended a “Active beauty in India” line held by “Cosmetics Design”. At the forum, Venkataramani pointed out that India’s beauty market is “glowing with unprecedented vitality”.

According to the Venkataramani report, according to H&G data over the past three months, sales of lipstick products have soared by 94%; followed by shadow and blush categories, which have increased by 72% and 66% respectively. In addition, the retailer observed a 57% increase in sales of sunscreen products, as well as base makeup and brow products.

“There is no doubt that consumers have kicked off the revenge consumption carnival.” Venkataramani said, “In addition, this group of beauty consumers after the epidemic is more willing to expand their horizons and explore new products that they have never tried before. Products — they might come from China, or they might come from South Korea.”

01: From “deadly” natural to embracing chemistry

Beauty culture is deeply ingrained in India, but there, women grew up with ancient Indian medicine. They believe in the value of all-natural ingredients—coconut oil for smooth and strong hair, and turmeric face masks for glowing skin.

“Natural, all natural! Our consumers used to expect everything in our products to be sourced from nature, and they thought adding chemicals of any kind would be harmful to the skin.” Laughs Bindu Amrutham, founder of Indian skincare brand Suganda “Maybe they really were decades ahead of the global trend (referring to the current ‘vegan’ beauty trend), but at the time, we had to climb up to the top of the store with a loudspeaker and yell: whatever Natural ingredients or chemical substances must pass the safety test first! Don’t put ten-day-fermented seaweed juice on your face!”

To Bindu’s relief, the efforts she and her colleagues have put in are not in vain, and the Indian beauty market has fundamentally changed. While many Indian women are still obsessed with homemade beauty products, more consumers have embraced modern technology—especially in skincare. Consumption of skin care products in India has been on the rise over the past five years, and market consultancy Global Data predicts this trend will continue to rise in the future.

02: From “self-reliance” to “open eyes to see the world”

According to data from the National Bureau of Statistics of India, nearly 10,000 Indian upstarts successfully enter the middle class every day, and many of them are white-collar women who, like white-collar women around the world, have strict beauty standards. This is also the beauty of India itself. The main reason for the rapid growth of the color cosmetics market in recent years. Purplle, another beauty retailer in India, also confirmed this view.

According to Taneja, at present, India’s most popular overseas products are not from Europe and the United States, but K-Beauty (Korean makeup). “Compared to European and American products that are mainly designed for whites and blacks, Korean products targeted at Asians are more popular with local Indian consumers. There is no doubt that the wave of K-Beauty has gradually arrived in India.”

As Taneja said, Korean cosmetic brands like Innisfree, The Face Shop, Laneige and TOLYMOLY are aggressively targeting the Indian market for expansion and investment. Innisfree has physical stores in New Delhi, Kolkata, Bangalore and major cities in northeastern India, and intends to further expand its footprint with new brick-and-mortar stores in southern Indian cities. The rest of the Korean brands tend to adopt a combined sales method that is mainly online and supplemented by offline. According to a report by INDIA RETAILER on Nykaa, another Indian beauty e-commerce platform, since the company signed a partnership agreement with some Korean cosmetic brands (which Nykaa did not disclose) to bring them to the Indian market, The company’s total revenue has grown substantially.

However, Sharon Kwek, consulting director of Mintel’s South Asia Beauty and Personal Care division, raised an objection. She pointed out that due to the price, the landing of “Korean Wave” in the Indian market may not be as smooth as everyone imagined.

“I do think K-Beauty is too expensive for Indian consumers, they have to pay expensive import duties and all other fees for these products. And according to our data, per capita consumption of Indian consumers on cosmetics is 12 per year USD. It is true that the middle class in India is growing massively, but they also have other expenses and don’t spend their entire salary on beauty products,” Sharon said.

She believes that C-Beauty from China is a better choice for Indian consumers than K-Beauty. “We all know that the Chinese are good at planning ahead, and almost every city-state in India has factories in China. If Chinese cosmetic companies intend to enter the Indian market, they will most likely choose to manufacture their products in India, which will help them greatly benefit consumers. Reduce costs. In addition, in recent years, China’s beauty and cosmetics industry has been constantly upgrading, they are good at drawing inspiration from international big-name and popular products, and adjusting them to produce their own products, but the price is only one-third of the big-name brands . This is exactly what Indian consumers need.”

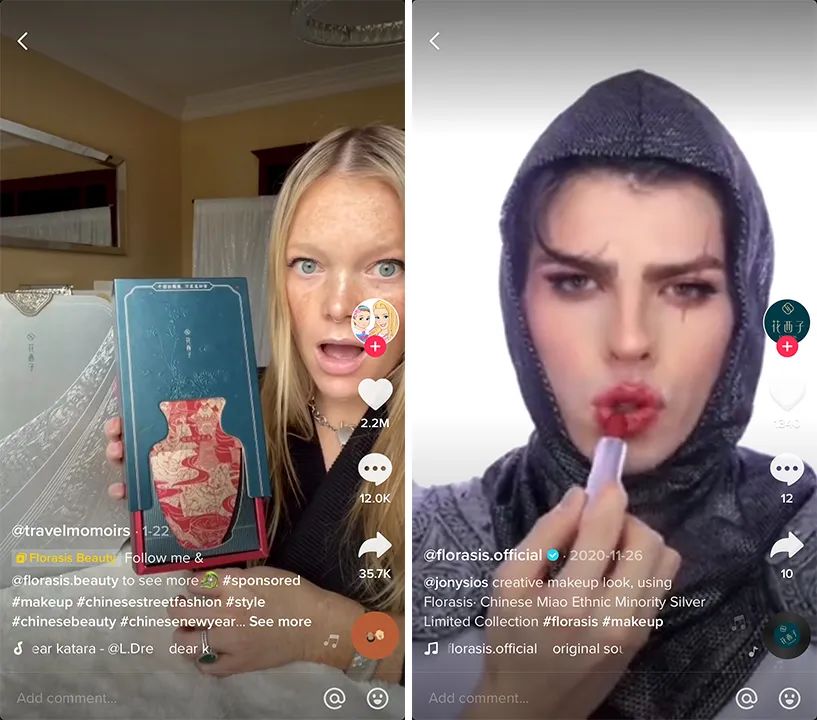

“But so far, C-Beauty has been quite cautious about the Indian market, and they are more willing to look to Southeast Asian markets, such as Malaysia, Indonesia and Singapore, which may be related to the frequent conflicts between the two countries.” “India Times” Journalist Anjana Sasidharan wrote in the report, “Take the example of C-Beauty standouts PerfectDiary and Florasis, both of which have a strong online following on social media, which has helped them as they break into new markets in Southeast Asia. The scale has been quickly established. On TIKTOK in India, you can also see that Florasis’s promotional video has received more than 10,000 comments and more than 30,000 retweets. Is the quality of cosmetics low?’, 75% of Indian netizens voted ‘no’ and only 17% voted ‘yes’.”

Anjana believes that Indian consumers do recognize the quality of C-Beauty, and will also share and forward promotional videos of Chinese cosmetics, lamenting their beauty, which will become an advantage for C-Beauty to enter the Indian market. But she also pointed out that when the question “Where can I buy C-beauty branded products?” on social media, there are always comments like “Beware, they are from our enemies.” “Naturally, Indian fans of PerfectDiary and Florasis will defend their favorite products, while opponents will bring in more allies to try to silence their voices – in the endless sparring, the brands and the products themselves are forgotten. .And in a question asking where to buy Korean cosmetics, you rarely see such a scene,” Anjana concludes.

Post time: Jul-26-2022