AmorePacific shifts cosmetic sales focus on US and Japan

AmorePacific, South Korea’s leading cosmetics company, is accelerating its push into the US and Japan to make up for sluggish sales in China, as pandemic lockdowns disrupt business and domestic companies appeal to increasingly nationalistic shoppers.

The shift in focus from the owner of brands Innisfree and Sulwhasoo comes as the company suffered a loss in the second quarter due to falling overseas revenues, with a double-digit drop in China over the first six months of 2022.

Investor concern over its Chinese business, which accounts for about half of the $4bn company’s overseas sales, has made AmorePacific one of the most shorted stocks in South Korea, with its stock price falling about 40 per cent so far this year.

“China is still an important market for us but competition is intensifying there, as mid-range local brands rise with affordable quality products tailored for local tastes,” Lee Jin-pyo, the company’s chief strategy officer, said in an interview.

“So we’re increasingly focusing on the US and Japan these days, targeting the growing skincare markets there with our own unique ingredients and formulas,” he added.

Expanding its US presence is critical for AmorePacific, which aspires to become “a global beauty company beyond Asia,” said Lee. “We aim to become a national brand in the US, not a niche player.”

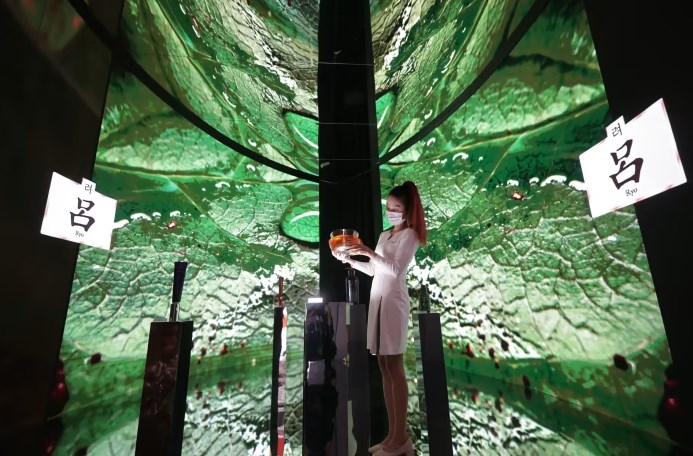

The company’s US sales rose 65 per cent in the first six months of 2022 to account for 4 per cent of its revenue, driven by best-selling items such as the activating serum of the premium Sulwhasoo brand and the moisture cream and lip sleeping mask sold by its mid-priced Laneige brand.

South Korea is already the third-largest exporter of cosmetics products in the US, after France and Canada, according to the US Department of Commerce, as cosmetics companies leverage the growing popularity of Korean pop culture to drive sales, using pop idols such as BTS and Blackpink for their marketing blitz.

“We have high expectations for the US market,” said Lee. “We are looking at some possible acquisition targets as this would be a better way of understanding the market more quickly.”

The company is buying Australian business Natural Alchemy, which operates the luxury beauty brand Tata Harper, for an estimated Won168bn ($116.4mn) as demand grows for natural, environment-friendly cosmetics products — a category that the company sees less affected by the looming global economic recession.

Although waning Chinese demand is taking a toll on the company, AmorePacific sees the situation as “temporary” and expects a turnround next year after closing hundreds of its mid-market brand physical stores in China. As part of the China restructuring, the company is trying to expand its presence in Hainan, the duty-free shopping hub, and to strengthen marketing through Chinese digital channels.

“Our profitability in China will start improving next year once we complete our restructuring there, ” said Lee, adding that AmorePacific plans to focus on the premium market.

The company also expects a sharp increase in Japanese sales next year, as its mid-range brands such as Innisfree and Etude gain popularity among young Japanese consumers. South Korea became Japan’s biggest cosmetics importer in the first quarter of 2022, overtaking France for the first time.

“Young Japanese prefer mid-range products that offer value but most Japanese companies focus on upmarket brands,” said Lee. “We are making a bigger push to win their hearts”.

But analysts question how much AmorePacific can seize of the crowded US market and if the China restructuring will be successful.

“The company needs to see a recovery in Asian sales for an earnings turnround, given the relatively small portion of its US revenues,” said Park Hyun-jin, an analyst at Shinhan Investment.

“China is getting more difficult for Korean companies to crack, because of the rapid rise of local players,” she said. “There is not much room for their growth as Korean brands are increasingly squeezed between premium European companies and lower-cost local players.”

Post time: Oct-27-2022