Chinese Makeup does not need “net celebrity” in Japan

I never imagined that one day I would be able to buy a domestic brand like Flower Knows in Japanese shopping malls. “Xiaoqi, a girl who studied in Japan, used to help domestic sisters to buy daily makeup, but in the past two years, she found that many Japanese girls are using domestic cosmetics.” For makeup brands like Flower Knows, there are special containers in LoFt in Japan. The name used is flower knows. “

Not long ago, an eyeshadow palette from the Chinese beauty brand Florasis appeared in the Japanese TV series “ANIMALS”. This domestic beauty product has already placed advertisements in the popular Japanese dramas, and the main product is this “Hundred Birds Chaofeng Makeup Plate”. The Chinese-style embossed pattern and classical screen elements, coupled with the bright red and gold color matching, made the Chinese audience who watched the drama recognize Florasis at a glance, exclaiming: “The domestic product has finally gone out!”

After the Chinese make-up brand went overseas to Japan, it was not only very popular, but also “doubled its value”. It is also a lipstick from a new domestic makeup brand. The domestic price is about 60-70 yuan, but after going overseas to Japan, the price has risen to 2,200 yen (about 110 yuan).

It has become the current industry trend for domestic beauty products to go overseas. According to data from China Customs, the export value of China’s beauty cosmetics and toiletries in 2021 will reach 4.852 billion US dollars (about 30.7 billion yuan), a year-on-year increase of 14.4%.

Faced with the current situation that domestic e-commerce is becoming more and more “rolling”, and domestic makeup brands are “reshuffling”, young makeup brands such as colorkey and Florasis have already launched “outbound” to break out into the Japanese and Southeast Asian markets. . Even in Japan, a place where beauty is highly developed, makeup with a strong Chinese style has become more and more popular.

In fact, since 2019, Chinese make-up brands have started the road of “going overseas”.From the initial Herborist to Europe, the store opened in France, MarieDalgar entered the Singapore market, One leaf, ZEESEA, etc. became the first wave of Chinese brands to “eat crabs” in the Japanese beauty market.

Compared with the European and American markets with fierce competition for international brand beauty products, Japan and Southeast Asia have gradually become the preferred markets for domestic cosmetics to go overseas.

Especially in Japan, the single-store sales and online response of Chinese makeup brands that have entered Japan in the past two years have been good.The local young group has strong spending power, and the beauty culture is prevalent. The offline retail channels are also very rich, and Chinese make-up brands are more easily accepted.

Since the Chinese-style imitation makeup of Japanese blogger “鹿の間” has exploded on the Internet at the end of 2019, Japanese social media has instead popularized “Chinese makeup”, which is typically characterized by more delicate eyebrows and brighter lip makeup.

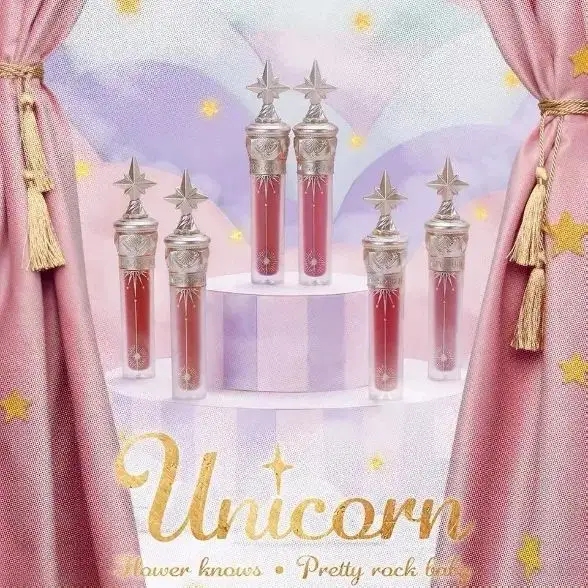

“Han makeup” has gradually become a makeup category that can compete with “Japanese makeup” and “Korean makeup”.At present, Chinese beauty brands that have opened up in the Japanese market include Florasis, colorkey, Flower Knows and so on.

Guo Xiruo, founder of Mold Breaking Moke, who has been promoting Chinese makeup brands to go to Japan for many years, told Xiaguang Club, “Although these are Chinese beauty brands that sell well in the Japanese market, in fact, what these brands present The intrinsic qualities that really appeal to Japanese consumers are very different.”

Although domestic make-up relies on novel design and fresh use experience, Japanese girls are crazy to “plant grass”. There are also many Chinese makeup brands that have successfully gone to Japan and become the “first batch of crab eaters”, but the “invisible ceiling” of many small domestic beauty brands still exists.

Japan’s retail ports are very mature, but online e-commerce is a supplement. In Japan, more than 90% of the color cosmetics sales are completed by offline stores. Japanese girls are more willing to go to offline daily grocery boutiques to choose color cosmetics products. At the entrance of offline stores, there are often a large number of product promotion visual materials to promote sales.

At the same time, Japanese domestic make-up brands care more about user stickiness and the feeling of maintaining old customers. For example, many brands regularly send emails to old customers to communicate their feelings through some greeting messages.

It can be seen that “selling the goods” is only the beginning of Chinese cosmetics brands going overseas to Japan. If you want to gain a firm foothold in the overseas makeup market for a long time, you must consider the establishment and improvement of brand influence.

From the production point of view, the R&D and production cycle of Japanese color cosmetics is longer and the investment is also larger. Japanese society attaches great importance to business credibility, and if Chinese makeup brands that basically rely on domestic shipments want to develop in Japan for a long time, they need to jump out of “products going overseas” and become “brands going overseas.”

In any case, as Chinese beauty becomes more and more popular in Japan, there are more and more things that overseas brands need to learn and adapt.

“Chinese cosmetics are so beautiful!” Yukina, a beauty blogger who has worked in the Japanese beauty industry for 16 years, wrote on her homepage. “For example, INTO U’s new lip balm is a popular Chinese cosmetic that has attracted much attention. It has sold more than 10 million bottles in Japan and Asia, and its functions are also quite good. Chinese cosmetics are becoming more and more popular!”

Post time: Sep-16-2022